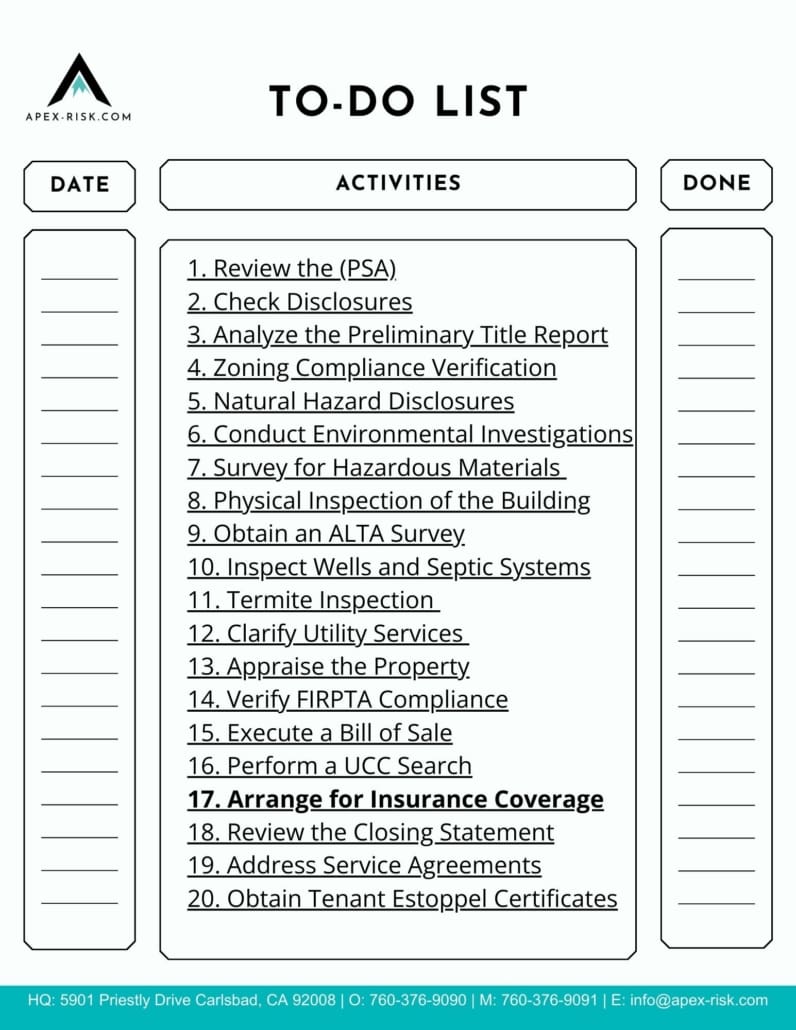

Comprehensive Commercial Real Estate Transaction Checklist

Understanding Key Dates in Real Estate Transactions

Effective Date of the Purchase and Sale Agreement

Duration of the Escrow Period

Predicted Date for Closing Escrow

Buyer’s Investigation Period for Due Diligence

Date When Earnest Money Deposit Becomes Non-Refundable

Commercial Real Estate Purchase Essentials

1. Reviewing the Purchase and Sale Agreement (PSA) In commercial transactions, the PSA is often customized. It’s vital to ensure that all conditions are met or waived in a timely manner.

2. Checking Disclosures Unlike residential transactions, commercial real estate purchases may not include mandatory seller disclosures. Always review the PSA to confirm that all required disclosures are in place.

3. Analyzing the Preliminary Title Report Order this report after opening escrow. It outlines the current title status, including easements, liens, and other title exceptions.

4. Zoning Compliance Verification Ensure that the property’s current or intended use complies with local zoning regulations. Non-conforming uses can lead to significant issues.

5. Understanding Natural Hazard Disclosures This disclosure reveals if the property is in a hazard zone like flood areas or earthquake zones, which could necessitate expensive insurance.

6. Conducting Environmental Investigations Perform a Phase I and, if necessary, a Phase II environmental investigation to mitigate potential liability for environmental issues.

7. Surveying for Hazardous Materials Engage an environmental engineering firm to check for hazardous materials such as asbestos or lead. Remediation, if needed, can be costly.

8. Physical Inspection of the Building Have the property inspected by a professional to assess the structure and systems before finalizing the purchase.

9. Obtaining an ALTA Survey This survey, crucial in real estate transactions, helps identify lot lines, easements, and setbacks issues.

10. Inspecting Wells and Septic Systems If present, these systems should be inspected due to the high costs associated with potential issues.

11. Termite Inspection Hire a pest inspection company to check for current and potential termite issues.

12. Clarifying Utility Services Identify all utilities servicing the property, including water, gas, electricity, and telecommunications.

13. Appraising the Property Choose a reputable appraiser accepted by your lender to determine the property’s fair market value.

14. Verifying FIRPTA Compliance Confirm the seller’s status regarding FIRPTA to avoid withholding tax liabilities.

15. Executing a Bill of Sale This document formalizes the transfer of personal property between buyer and seller.

16. Performing a UCC Search A UCC search reveals any encumbrances on personal property involved in the transaction.

17. Arranging for Insurance Coverage Consult Apex Risk for property and liability insurance, often required by lenders.

18. Reviewing the Closing Statement This document details all costs and financial transfers between the buyer and seller.

19. Addressing Service Agreements Understand which service agreements will be assigned to you or terminated at closing.

20. Obtaining Tenant Estoppel Certificates These confirm lease terms and check for any defaults under current leases.

At Apex Risk and Insurance Services, we understand the complexities of commercial real estate transactions. Our comprehensive checklist ensures that you’re well-prepared for every step of the process, minimizing risks and paving the way for a smooth transaction.