What Makes Apex Insurance Different?

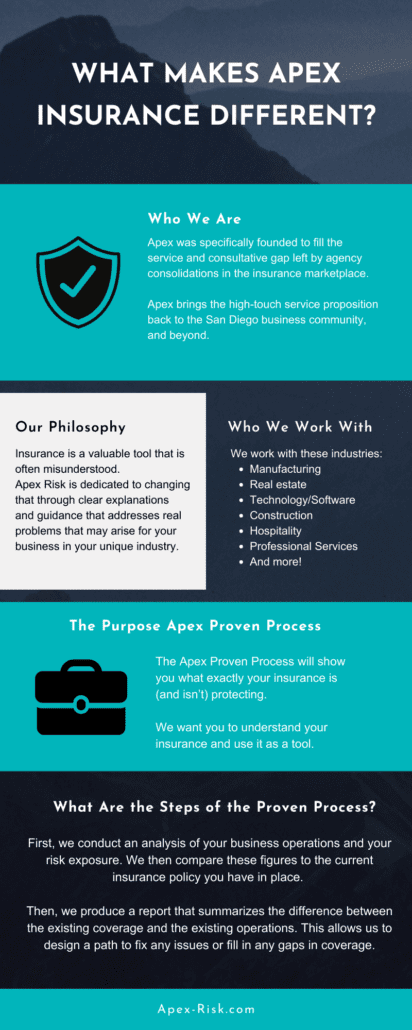

Apex was founded to fill the service and consultative gap left by agency consolidations in the insurance marketplace.

These consolidations have left customers who are used to a boutique service approach with no personal connection to their team.

Apex brings the high-touch service proposition back to the San Diego business community, and beyond.

But what makes us different from our competitors? Let’s start with the Apex Proven Process.

The Apex Proven Process

We take the time to understand the full operations of your business. We use this information to do a deep dive into the insurance program, asking questions including:

- What coverage do you have?

- What are the limits?

- How much does it cost?

Our team uses these comparisons to find where improvements can be made in your program.

First, We Analyze

We conduct an analysis of your business operations and your risk exposure. We then compare these figures to the current insurance policy you have in place.

Then, We Report

We produce a report that summarizes the difference between your existing coverage and existing operations. This allows us to design a path to fix any issues and fill in any gaps in coverage.

We Take on the Heavy Lifting

We understand that switching insurance plans is a big commitment. That’s why we do our analysis and research, and build a plan before doing the work for our client on the backend.

What is the Purpose of the Apex Proven Process?

The Apex Proven Process will show you what exactly your insurance is (and isn’t) protecting. We want you to understand your insurance and use it as a tool.

It’s part of our philosophy.

Our Philosophy

Insurance is a valuable tool but many don’t know how to use it. Somehow, the most successful entrepreneurs obtain degrees and launch businesses without gaining an understanding of how to fairly and intelligently manage the risks that may come with running that business.

Apex Risk provides clear explanations and guidance that address real problems that may arise for your business in your unique industry.

Who We Work With

If you run a business with complexity, we provide custom solutions to meet your insurance needs.

Your business changes regularly, and so should your understanding of your insurance coverage. Did you buy new equipment, or purchase or sell a property? Have you invested in a new business or do you work in a new geographic location? Any of these changes might merit a reduction in or addition of insurance.

We work with these industries:

- Manufacturing

- Real estate

- Life sciences

- Technology/Software

- Construction

- Hospitality

- Professional Services

- Retail

- Transportation and Logistics

A Final Word

You deserve the kind of care and attention paid to you that you pay to your own clients. Most brokers make you sign a broker of record agreement and then ignore you until it’s time to renew.

That’s not us. We use the Apex Proven Process to learn about your business, strategize to assemble the right program for you, and use our deep industry and market knowledge to leverage the best pricing and coverage, and ultimately help guide your decision-making.

Ready to Get Started?

Contact us and find out what you’ve been missing or learn more about our personal and commercial insurance.