Underinsured Homeowners and Inflation

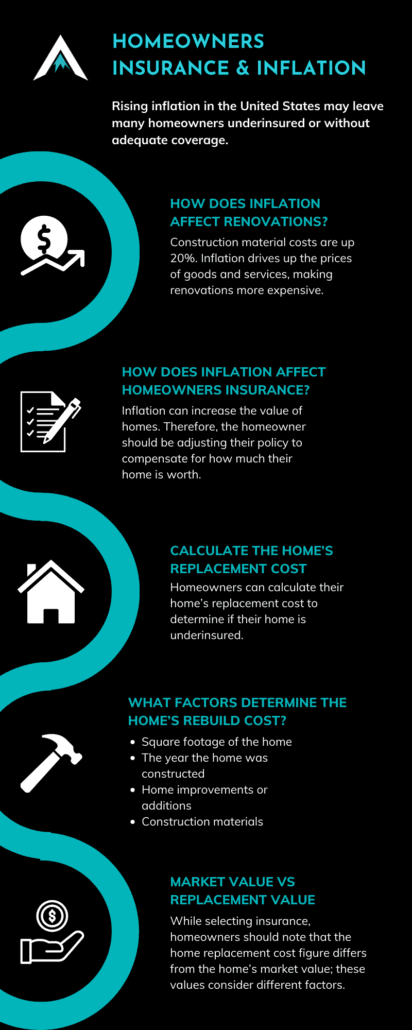

Rising inflation rates in the United States may leave many homeowners underinsured or without adequate coverage.

Underinsured homeowners may find themselves paying out of pocket to cover repairs in the event of damage to their home. To avoid this, homeowners can take precautionary measures such as accurately calculating the replacement cost of their home and updating their coverage limits accordingly.

How Does Inflation Affect Homes and Renovations?

During standard periods of inflation, the rate of inflation increases approximately between 2% and 3% per year. However, the U.S. is currently experiencing an overall higher rate of inflation, especially in industries such as construction.

In fact, construction material costs are up 20% according to the General Contractors of America.

Inflation drives the prices of goods and services up, such as the cost of:

- Goods/Materials

- Production

- Labor

- Resourcing

Additionally, supply disruption, and construction labor shortages, may also result in an increase in these prices. Homeowners should be aware of these increases and how they affect the value of their homes.

How Does Inflation Affect Homeowners?

To put it simply, inflation can increase the value of homes as well as the cost and value of renovations. In most cases, this is a positive outcome for homeowners; they’re holding an asset growing in value that will likely sell quickly. For instance, the National Association of Realtors estimates that homes spent only an average of seventeen days on the market during March of 2022.

However, the issues for homeowners arise when they do not properly insure homes for their full and accurate value. Therefore, in the case of an event damaging or destroying their homes, underinsured homeowners are left paying more out of pocket–not such a positive outcome.

How Does Inflation Affect Homeowner’s Insurance?

According to a survey conducted by The Harris Poll, only 30% of insured homeowners have increased coverage or purchased more insurance to compensate for the effects of inflation, such as rising building costs.

Further, 60% of homeowners who completed renovations or remodels during the pandemic did not update their insurance to include these alterations.

Inflation may cause insurance premiums to increase. As a result, this increase may cause homeowners to be hesitant to invest in the right policy and instead opt for minimal coverage. However, many companies recommend that homeowners to insure their homes for at least 100% of their accurate value, if not more.

Homeowners should be adjusting their policy to compensate for how much their home and renovations are worth. With inflation generating increased home values, unfortunately, homeowners have more to lose.

How Do Homeowners Know What Insurance to Buy?

Homeowners can calculate their property’s replacement cost to help them determine which insurance policy is right for them.

Calculate The Home’s Replacement Cost

The home replacement cost is the total amount of money required to rebuild or repair a home to its original state. Homeowners can calculate their home’s replacement cost using a few factors and basic information about their home.

What Factors Determine the Home’s Rebuild Cost?

The home rebuild or replacement cost depends on factors such as:

- Square footage of the home

- Type of roof

- The year the home was constructed

- Local building codes

- Foundation type

- Outdoor features

- Home improvements or additions

- Construction materials

Moreover, homeowners–especially those whose homes may require additional factors to be included in the replacement cost, such as an old property or a home with architectural features–may consider hiring assistance in calculating their home’s replacement cost.

For example, insurer appraisals or professional appraisals can help homeowners to determine an acceptable replacement cost and properly insure their homes.

Insurer Appraisal

Home insurance companies may have their own methods and tools to calculate home replacement value. By going through insurance companies, homeowners can receive a more accurate estimation of their home replacement value than if they attempted to determine this themselves.

Professional Appraisal

In-person appraisals can provide an accurate estimate for the replacement cost of a home by considering more factors than simply the square footage and materials of the home. Professional appraisals can help homeowners know and understand the cost replacement value of their home and accordingly purchase the best-suited insurance.

Any Questions?

For more information, contact us today or check out our policies.

Apex Risk is dedicated to providing clear explanations and guidance that addresses real problems that may arise for your business in your unique industry. Learn who we are and why we do what we do, here.