Errors & Omissions (Correction: We Misstated)

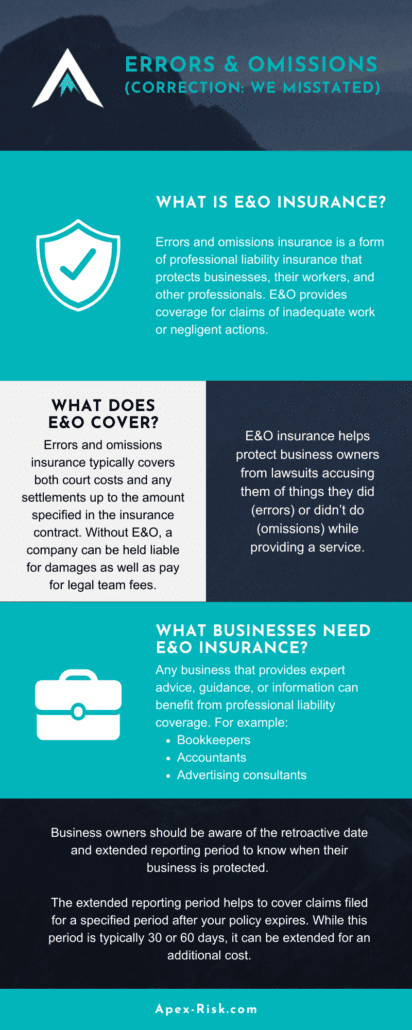

Errors and omissions insurance is a form of professional liability insurance that protects businesses, their workers, and other professionals. E&O provides coverage for claims of inadequate work or negligent actions.

Watch the video below as Peter Katkov, the founder of Apex Risk and Insurance Services, explains E&O insurance.

What is E&O Insurance?

We like to break it down like this: E&O insurance helps protect business owners from lawsuits accusing them of things they did (errors) or didn’t do (omissions) while providing service.

Examples of Uses for E&O Insurance

E&O insurance can be used in a range of industries and situations. Let’s review some examples of when business owners could utilize E&O after making a mistake.

- An interior designer orders a piece of custom furniture for her clients. The custom furniture doesn’t fit in the space they planned. The clients sue the interior designer to recoup the cost of the furniture.

- A tax preparer fails to file a client’s tax return before the deadline. As a result, the client owes a fine. The client sues the tax preparer to recoup the fine.

- A real estate agent makes a mistake on an MLS sheet and incorrectly records the square footage of the property. After the clients purchase the space, they realize the mistake and sue the agent.

What Does E&O Insurance Cover?

While plans can vary, E&O insurance typically helps to protect your business against the following claims:

- Errors, mistakes, or oversights in the provided service

- Inaccurate professional advice

- Violation of good faith

- Missed deadlines

- Failure to deliver a service

- Breach of contract

- Omissions

- Misrepresentation

- Professional negligence

- Failure to meet a standard of care

How Does E&O Insurance Work?

If someone claims that your business made an error and sues, E&O insurance may help cover:

- Damages and expenses

- Judgments or settlements

- Legal fees (i.e. attorney fees)

- Court costs (i.e. paying for witnesses or reserving a courtroom)

Errors and omissions insurance typically covers both court costs and any settlements up to the amount specified in the insurance contract.

Without E&O insurance, a company can be held liable for damages as well as pay for legal team fees. E&O insurance helps mitigate or eliminate this risk.

Understanding the Retroactive Date and Extended Reporting Period

The business owner must have a policy at the time of the claim to be protected. If the coverage lapses, the business owner is not eligible for coverage.

The retroactive date means the business is covered for events that happen on or after a specified date in your policy.

The extended reporting period helps to cover claims filed for a specified period after your policy expires. While this period is typically 30 or 60 days, it can be extended for an additional cost.

Business owners should be aware of the retroactive date and extended reporting period to know when their business is protected.

What Does E&O Insurance Not Cover?

E&O insurance may not cover:

- Purposeful wrongdoing or negligence

- Illegal activity

- Data breaches resulting from a cyberattack

- Employee injuries

- Employee harassment claims

- Employee discrimination claims

- Bodily injured caused by a business

- Property damage caused by a business

What Businesses Need E&O Insurance?

Any business that provides expert advice, guidance, or information can benefit from professional liability coverage. For example:

- Bookkeepers

- Accountants

- Advertising consultants

- Software development companies

- Engineering firms

- Architectural firms

- Insurance agents or companies

- Website developers, software developers, or IT professionals

- Businesses in the beauty and/or salon industry (i.e. hairstylists and barbers)

- Wedding planners

Medical professionals, such as doctors and dentists, also take out E&O insurance called malpractice insurance.

How Much Does E&O Insurance Cost?

The cost of errors and omissions insurance varies depending on factors such as the needs of the business, industry risk, coverage limits, and claims history.

Industry or Business Risk

If your business is in a high-risk industry, you’re more likely to pay a higher premium. To access this risk, your insurer may review lawsuits in your industry.

Coverage Limits

The amount of coverage a business will need also affects how much the insurance will cost.

Claims History

An insurer may also consider any past claims your business has filed. A person or company with multiple litigation problems has a higher underwriting risk and may experience higher rates.

Do You Need E&O or Professional Liability Insurance?

At Apex, we want you to know and understand your options. We prioritize transparency and provide custom solutions to meet your insurance needs.

While professional liability insurance (PL) and errors and omissions (E&O) insurance are used interchangeably in some industries, the two forms of liability insurance have a few technical differences. Learn which policies are best for your business here.Review our commercial insurance policies here.