Why are Workers’ Compensation Rates Rising?

Employers in California are required to purchase workers’ compensation to protect against work-related injuries and illnesses.

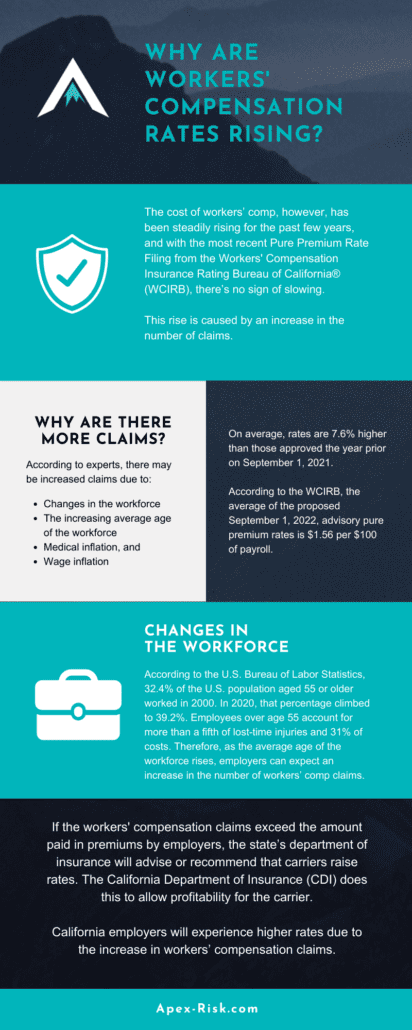

The cost of workers’ comp, however, has been steadily rising for the past few years, and with the most recent Pure Premium Rate Filing from the Workers’ Compensation Insurance Rating Bureau of California® (WCIRB), there’s no sign of slowing.

But why are these rates rising in the first place?

Changes in the workforce, medical inflation, and wage inflation have all played a part. Read on to learn what rising workers’ compensation rates mean for California employers.

What is the WCIRB?

First, what is the WCIRB?

The WCIRB or Workers’ Compensation Insurance Rating Bureau of California is “California’s trusted, objective provider of actuarially-based information and research, advisory pure premium rates, and educational services integral to a healthy workers’ compensation system.”

The WCIRB’s Pure Premium Rate Filing

In July of 2022, the WCIRB submitted its September 1, 2022, Pure Premium Rate Filing to the California Department of Insurance (CDI).

In this filing, the WCIRB proposed a set of increased premium rates. On average, these rates are 7.6% higher than those approved the year prior on September 1, 2021.

According to the WCIRB, the average of the proposed September 1, 2022, advisory pure premium rates is $1.56 per $100 of payroll.

Read on for the WCIRB filing.

Understanding Why Workers Comp Rates Are Rising

The California Department of Insurance (CDI) regulates workers’ compensation insurance rates in California. The CDI is influenced by advice from the WCIRB.

The WCIRB makes recommendations, in part, based on the state’s “loss ratio.”

What is the Loss Ratio?

In simple terms, a loss ratio is “the percent of the money paid out in claims relative to the money earned from employer premium payments.”

If the workers’ compensation claims exceed the amount paid in premiums by employers, the state’s department of insurance will advise or recommend that carriers raise rates.

The CDI does this to allow profitability for the carrier.

How Does This Loss Ratio Affect California Employers?

California employers will experience higher rates due to the increase in workers’ compensation claims.

Why Are There More Workers’ Compensation Claims?

According to experts, reasons there may be an increase in workers’ compensation claims include:

- Changes in the workforce

- The increasing average age of the workforce

- Medical inflation spurred in part by expensive medical technology

- Rising wages, and

- Higher indemnity costs

Changes in the Workforce

According to the U.S. Bureau of Labor Statistics, 32.4% of the U.S. population aged 55 or older worked in 2000.

In 2020, that percentage climbed to 39.2%.

In 2021, 23% of the U.S. workforce was older than 55, which is a 13% increase from nearly 20 years before in 2000.

According to Business Insurance, employees over age 55 account for more than a fifth of lost-time injuries and 31% of costs. Therefore, as the average age of the workforce rises, employers can expect an increase in the number of workers’ compensation claims.

Labor Shortage

The labor shortage has resulted in employers hiring less experienced employees, which has contributed to the rise in workers’ compensation claims.

Industries such as construction and manufacturing are more susceptible to accidents resulting from this change.

Medical Inflation

In 2021, medical price inflation jumped 4.3% from the previous year. This increase also contributed to the rise in workers’ compensation premiums.

Wage Inflation

According to the National Council on Compensation Insurance (NCCI), “the US economy is facing nonuniform wage inflation across the workforce like never before…

“As wages rise, premiums automatically rise along with workers’ compensation benefits. Wages, premiums, and indemnity benefits typically stay in balance.”

Still Have Questions?

Workers’ comp is a need-to-have insurance policy and a significant cost for most business owners. This considered, the market shifts daily and your broker should work hard to get the best it has to offer.Read on to check out our commercial insurance policies (including workers’ comp!)