Small Businesses: Your Guide to Workers’ Compensation

Adopted in most U.S. states nearly a century ago, workers’ compensation insurance is the oldest American social insurance program. Since then, workers’ comp has become required in nearly all states as soon as a company hires its first employee.

In this guide for small businesses, we’ll review all the information that small business owners need to know to get started with workers’ compensation insurance.

Let’s dive in.

What is Workers’ Compensation Insurance?

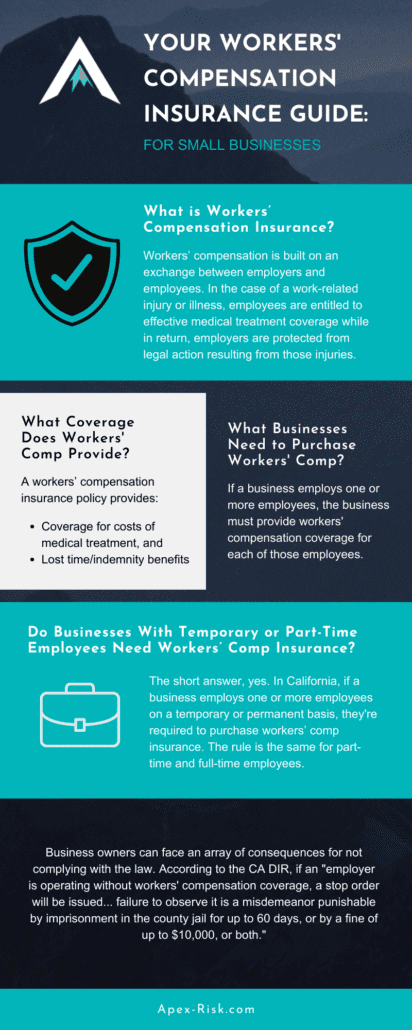

Workers’ compensation is built on an exchange between employers and employees. In the case of a work-related injury or illness, employees are entitled to effective medical treatment coverage while in return, employers are protected from legal action resulting from those injuries.

Through this arrangement, both parties are protected and reduce conflicts when accidents occur in the workplace.

What Coverage Does Workers’ Compensation Provide?

A workers’ compensation insurance policy provides:

- Coverage for the costs of medical treatment, and

- Lost time or indemnity benefits

Let’s take a look at each of these in detail.

Coverage for the Costs of Medical Treatment

In the event of an accident at the workplace, workers’ comp insurance covers the cost of immediate medical care. These costs may include:

- An ambulance ride

- Emergency room visit

- An appointment with a physician

- Prescription medications

- Surgeries

- Hospital stays, and

- Other medical costs

For example: A retail employee is stocking shelves at their workplace using a ladder. They slip, fall, and break their arm. Workers’ comp will pay for the ambulance ride to the hospital as well as any necessary surgery, medications, and physical therapy.

Lost Time or Indemnity Benefits

After experiencing an incident in their workplace, an employee may be unable to return to work for some time. Lost time and indemnity benefits pay part of these lost wages while the employee recovers from the injury or illness.

How are these benefits calculated? According to the Workers’ Compensation Insurance Rating Bureau of California® (WCIRB), “indemnity benefits are calculated on the basis of an injured worker’s weekly wage and determined pursuant to applicable California laws.”

For instance: An employee working in a manufacturing plant drops a piece of equipment onto their foot and breaks several bones. This employee must stay off their feet for six weeks to recover before returning to work. Workers’ comp will provide lost wages for this employee during recovery.

What You Need to Know About No-Fault Laws

In California, workers’ compensation laws are no-fault laws. No-fault compensation is based on the concept that injured employees are entitled to compensation without having to prove fault against the other party.

What does this mean for business owners? It doesn’t matter who is at fault for the incident. You do not have to admit guilt in the incident and the employee doesn’t need to start a lawsuit against you. Instead, employees need only prove that the injury arose from the “course and scope” of their employment.

These laws were designed to reduce the number of lawsuits against employers as well as make the process of an employee receiving compensation more efficient.

Exceptions to the No-Fault System

There are a few exceptions to the no-fault system that small business owners should be familiar with. These include:

- Intoxication: If injuries were primarily caused by the use of drugs or alcohol

- Intentional Infliction: If an employee purposefully caused their injuries

- Fighting: If a fight between staff members or with a customer causes injuries, except for self-defense

- Horseplay: If employees are messing around at work and cause an injury unrelated to their responsibilities

What Businesses Need Workers Compensation Insurance?

Under California Labor Code Section 3700, if a business employs one or more employees, the business must provide workers’ compensation coverage for each of those employees. However, if you are the sole proprietor of your company, you do not need to purchase workers’ comp insurance.

In California, it is a criminal offense for business owners to fail to have workers’ compensation insurance if they employ one employee or more.

Do Businesses With Temporary or Part-Time Employees Need Workers’ Compensation Insurance?

The short answer, yes. In California, if a business employs one or more employees on a temporary or permanent basis, they are required to purchase workers’ comp insurance. The rule is the same for part-time and full-time employees.

For example: An accountant who owns their own firm decides to hire an employee during tax season to work 20 hours a week to help with additional administrative work. Even though this position is temporary and part-time, the business owner must provide workers’ compensation benefits.

Can Small Business Owners Be Fined For Not Providing Workers’ Compensation?

Business owners can face an array of consequences for not complying with the law.

According to the Department of Industrial Relations (DIR), “if the Division of Labor Standards Enforcement… determines an employer is operating without workers’ compensation coverage, a stop order will be issued…. and failure to observe it is a misdemeanor punishable by imprisonment in the county jail for up to 60 days, or by a fine of up to $10,000, or both.”

What Factors Affect How Much Workers’ Comp Will Cost for Small Businesses?

California does not regulate premiums for workers’ comp insurance. This means that rates will vary amongst insurance carriers. Typically, premiums are determined by a set of factors, such as:

- Industry classification

- Special underwriting adjustments

- Group or dividend programs, and

- Employer history/experience modification

Read on to learn why workers’ compensation insurance rates are rising.

Looking to Purchase Workers’ Comp Insurance?

Small business owners already have a lot on their plates. They shouldn’t also have to worry about purchasing the correct workers’ compensation insurance too.

At Apex Risk & Insurance Services, we use The Apex Proven Process to learn about your business, strategize to assemble the right program for you, and use our deep industry and market knowledge to leverage the best pricing and coverage.

This leaves small business owners with more time to do what they do best: Run their business knowing that their company and employees are protected.

Check out our commercial insurance policies, then, read on to learn how to protect your business from cyberattacks.