What Does Property and Casualty Insurance Cover?

Property and casualty insurance –also known as P&C insurance– protects property owners and the property they own. P&C insurance is a broad term that includes several different forms of insurance such as homeowner’s insurance, renter’s insurance, and auto insurance.

How Does Property and Casualty Insurance Work?

P&C insurance functions like other types of insurance. In the event of personal property being damaged, owners can file a claim with their insurance company to be reimbursed for the property repairs or losses. Or, if an individual sues the owner for damages, liability insurance can help cover this claim.

What Does Property and Casualty Insurance Cover?

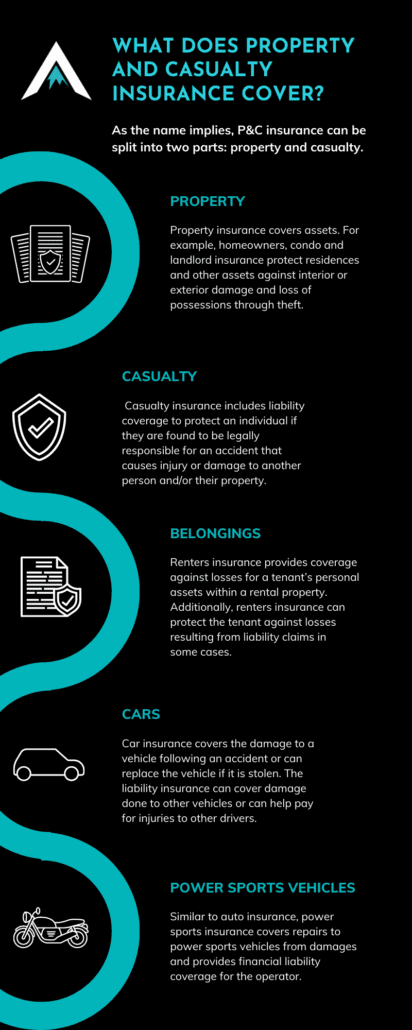

As the name implies, P&C insurance can be split into two parts: property and casualty.

Property

Property insurance covers assets, such as structures, belongings, houses, high-value toys, cars, and even the property your business owns. The property aspect of P&C insurance protects against interior or exterior damage, vandalism, theft, damage from weather-related events such as wind or fire, and more.

Casualty

Casualty insurance includes liability coverage. This protects an individual from being legally responsible for injuring another person or damaging another person’s property. Typically, casualty insurance will cover court costs and retributions the individual is required to pay up to their coverage limits.

What Does Property and Casualty Insurance Not Cover?

Most insurance will offer some form of a property and casualty plan. However, these plans do not include health and life insurance.

Property and Casualty Insurance Bundles

Property and casualty insurance are typically bundled together into one insurance policy. For example, these policies may include:

- Homeowners insurance

- Renters insurance

- Landlord insurance

- Condo insurance

- Car insurance

- Powersports insurance

Coverage can vary per bundle. Read on to learn what each policy generally offers regarding personal property and liability coverage.

Homeowners Insurance

Homeowners insurance is a type of property insurance that protects homes and other assets against interior or exterior damage and loss of possessions through theft. Typically, homeowners insurance covers the home, furnishings, and other belongings and provides liability coverage against accidents on the property.

Homeowner’s insurance includes three basic levels:

- Actual cash value

- Replacement cost

- Extended replacement cost/value

Renters Insurance

Renters insurance provides coverage against losses for a tenant’s personal assets within a rental property. Additionally, renters insurance can protect the tenant against losses resulting from liability claims in some cases.

Landlord Insurance

Landlord insurance varies by plan but typically covers the damages to physical property as well as offers liability protection. Nearly 75% of landlord liability lawsuits could have been avoided with a simple landlord insurance policy.

Condo Insurance

Condo insurance is similar to homeowners insurance, protecting against losses and damages, but is specific to a condominium unit.

Auto Insurance

Property and casualty insurance also includes auto insurance. Car insurance covers the damage to a vehicle following an accident or can replace the vehicle if it is stolen. The liability insurance can cover damage done to other vehicles or can help pay for injuries to other drivers.

Power Sports Insurance

Similar to auto insurance, power sports insurance covers repairs to power sports vehicles from damages and provides financial liability coverage for the operator.

Property and casualty insurance may cover power sports such as:

- Motorcycles

- Boats

- ATVs

- Recreational vehicles

- Personal watercrafts

- Travel trailers

Looking for More Information?

Check out our policies and how they can help to protect your property, here.

Apex Risk is provides clear explanations and guidance that addresses real problems that may arise for your business. Learn who we are and why we do what we do, here.