Why Are Directors & Officers (D&O) Insurance Rates Increasing?

As company leaders look to protect their leadership, they may notice a rise in rates for D&O insurance. The Directors’ & Officers’ (D&O) liability insurance market experienced huge rate increases in 2020; with some of these increases peaking at over 70%.

Before we dive into why these spikes are happening, let’s review what D&O insurance is, what it covers, and potential risk scenarios.

What is Directors and Officers (D&O) Liability Insurance?

Directors and officers (D&O) insurance offers liability coverage for company directors and officers to protect them if they are sued as a result of fulfilling the responsibilities associated with their position.

D&O insurance serves as a standard indemnification provision, which protects officers in their business role. For more information, check out our full guide to Directors & Officers insurance, here.

What Does D&O Insurance Cover?

Directors and officers insurance can cover costs associated with:

- Legal action taken against insured individuals (i.e. settlements and defense costs)

- Other costs associated with wrongful act allegations and lawsuits

What Parties Might Sue Directors and Officers?

The parties suing a director or officer may include:

- Investors

- Customers

- Employees

- Vendors

- Competitors, and

- Other parties

Common D&O Risk Scenarios

Some common D&O risk scenarios include the following:

- Employment malpractice

- Reporting errors

- Inaccurate disclosures

- Insolvencies, and

- Regulation violations

What Businesses Need D&O Insurance?

All public and private companies should invest in D&O liability insurance if they raise capital, negotiate contracts, and grow. It’s important to note that small businesses are particularly vulnerable to D&O lawsuits.

Why Are Directors and Officers Insurance Premiums Rising?

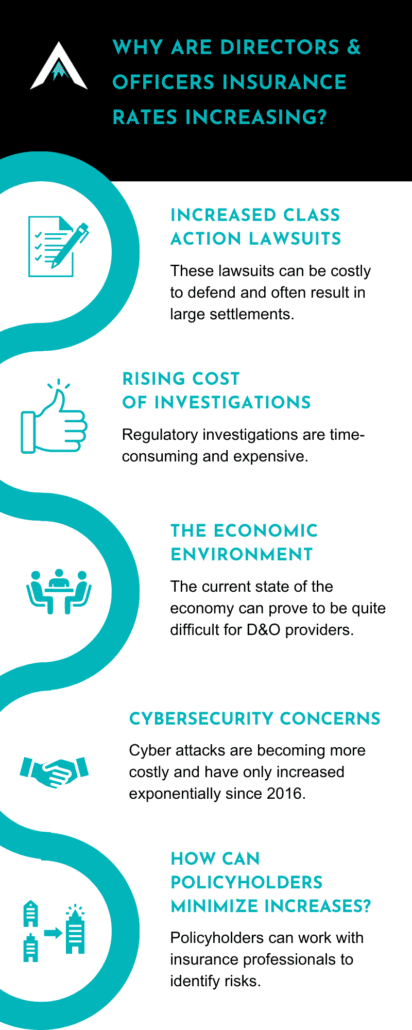

According to FitchRatings, possible reasons for spikes in D&O insurance premiums include increased mergers, class action lawsuits, and the cost of regulatory investigations.

Moreover, the current economic environment post-pandemic may be impacting insurers and driving up rates.

Increased Class Action Lawsuits

The increased frequency of class action lawsuits impacts the rates of D&O insurance.

These lawsuits can be costly to defend and often result in the payment of large settlements. Due to increased lawsuits, D&O insurers have had to pay out more in claims than in the past. As a result, insurers may raise rates to compensate for these increases.

Rising Cost of Regulatory Investigations

Regulatory investigations are time-consuming and expensive. Additionally, these investigations may result in additional fines or penalties.

The Economic Environment

The current state of the economy can prove difficult for directors and officers insurance providers. For example, the stock market is more volatile and leads to several high-profile corporate bankruptcies.

Concerns with Cybersecurity

Cyber attacks are becoming more costly and common each year, growing exponentially since 2016. Potential D&O risks can result from such attacks if leaders fail to take the necessary steps to protect against data breaches and other cyber attacks.

Additionally, directors and officers may face allegations of not notifying all parties or reporting the incidents.

New standardized requirements regarding cyber security practices may cause more D&O losses if leaders fail to comply. The U.S. Securities and Exchange Commission proposed changes such as:

- Enhanced and standardized rules regarding cybersecurity governance

- Risk management methods

- Incident reporting practices, and

- Overall strategy to prevent and navigate cybersecurity attacks

A Spike in Employment-Discrimination Claims

Public companies are exposed to corporate misconduct, and leaders are facing increased liability in areas such as sexual harassment and employee discrimination.

These claims could fall under employment practices liability insurance (EPLI) coverage, but many modern allegations also include a lack of management oversight or training.

Private companies and nonprofit organizations are also affected by this additional exposure.

How Can Policyholders Minimize D&O Premium Increases?

Luckily, policyholders can take steps to reduce their risk and therefore, avoid rising rates. These steps include:

- Investing in cybersecurity training; be sure leadership participates and monitors cybersecurity threats

- Review D&O risk scenarios with leadership to prevent future claims

- Work with insurance professionals to identify and adjust any current risks that could lead to D&O losses

Need Help Assessing Your Risk?

At Apex Risk & Insurance Services, we bring the high-touch service proposition back to the San Diego business community, and beyond. We use the Apex Proven Process to guide you to the right coverage for your organization.

Read on to learn more about Apex’s commercial insurance options, including D&O, and what makes Apex Insurance different from its competitors. Then, check out our full guide to directors and officers insurance.